About Dad

My Story

What am I trying to accomplish?

After many years of scouring the internet, I found good information but it never seemed to be directly pertinent to those who are entering the workforce. There are a lot of web sites that discuss how to get out of debt, how to retire by some magic number like 30, 40 or 50, or what it’s like being retired? But what I didn’t find was a site that discussed the planning and decision making that it took for the everyday working person. Where do my children and grandchildren go to learn financial skills?

What is my why?

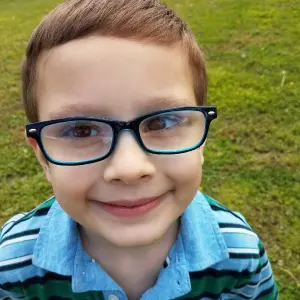

Have you ever heard anyone say that to accomplish a goal, one needs to have a why? Well in my case the why is in the photo. It is now all about my legacy. It is amazing how things change once you get older. It is no longer about the personal goals but it is now all about trying to make the world a better place for my daughter, son and grandsons. Making sure that they get what they need to become successful and happy. Look at the smile on those little guys. I am very lucky to have my grandsons, my son, daughter and their spouses in my life.

Who am I?

I am many things. But most people define this by their job. I am not defined by what I do for a living but working a full time job does occupy a lot of one’s time and does influence his or her social life. So, I became part of what was very new at the time once upon a time ago. A computer science graduate before there was any thought of personal computers by the masses. It was the time of the main frame computer and mini computers had just made their start into the market place.

That wasn’t enough so I continued my education while working and picked up a computer engineering master’s degree. I suppose it was a big deal at the time since no one that I know of in my family or extended family had accomplished that feat to date. Since then, a few other family members have traveled that path as well.

I also taught computers, economics and business courses at a small business school as well as at one of the largest private Universities in the world. The large private university had also asked me to become an assistant department chair. This granted me the opportunity to help out with hiring staff and defining the course curriculum. A great experience.

I am also a frustrated athlete. One with no natural ability but worked very hard at playing baseball, basketball and working out in the gym. So I am still playing today but there was no way that I was going to become a professional athlete even though I grew up believing that every day of my childhood.

What about the name of the site?

Well, I never prided myself much as being a reader but obviously I had to read a lot to get through undergraduate and graduate school. So reading was math books and technical manuals. These days, all my reading occurs in financial books, periodicals and web sites. And I cannot get enough.

This brings me back to the why I am creating the site. There just weren’t many resources that discussed what goes into day by day financial planning. I was fortunate enough to have a father who always discussed personal finance with me as a young child. Perhaps I was just a sounding board while traveling with him on his long sales trips. Or perhaps he knew exactly what he was doing.

This site is named Dads Personal Finance in honor of my Dad who took the time to ensure that he was enabling the next generation to succeed. The other reason for the name is who better to trust than your Dad.

One of the things that used to really bother me was that I would get financial advisors calling me and asking to do a free portfolio analysis. My first thought was always to think about asking them to let me see their million dollar+ portfolio. If I was going to take any advice, it better be from someone who had built a massive portfolio. Its like signing up for the gym and then getting the little fat kid with pimples to show me how to use the machines. Why would I want to learn from some who wasn’t physically or financially fit?

Thank goodness I listened to that little voice in my head. So what I offer the reader is the fact that I have already accomplished this goal and then some. I didn’t do it through being part of a company acquisition or an inheritance. I did it through hard work, spending less than I made and saving along with investing. Note that I don’t advocate that you do anything I have done. The content on this site is for entertainment purposes and you shouldn’t implement anything I have done without consulting your professional advisor(s).

The biggest driver for this blog is that I believe I had been too passionate about personal finance and it turned my children off. Enough so that they have tuned me out should I start speaking about the subject. I am OK with this. But it is still my responsibility that they have the information that they will eventually need. Hopefully they will make it to this blog to obtain the personal finance information they need when they are ready for it. It is my responsibility as a parent to do everything I can to set them up for success.

Unfortunately, becoming financially successful has a simple formula like losing weight. For losing weight, you simply need to move more and eat less. To become financially successful, you need to live below your means and invest the difference. Or make more, spend less, and save/invest the difference. It’s unfortunate as it is so easy but it is also so elusive. On this site, we will investigate the nuisances behind this notion of becoming financially independent.

But most importantly, this is not about me. This is about you. How may I best serve you?

Feedback & Reviews

Some feedback from Dad’s followers

Patricia Bonitatibus

Register Nurse, Schenectady, New York

” Dad’s Personal Finance helped me with reconciling my Father’s estate after he had passed. “

Kathy Blanchette

Lead Adjuster at Gage Adjustments in Guilderland, New York

” Dad’s Personal Finance helped me with getting back on track financially following a long an drawn out divorce. “

Kevin Guidinger

Director of Security Product Management in Liberty Hill Texas

” Dad’s Personal Finance was instrumental in helping me create my financial plan. “

What Can I Do For You ?

Please dont hesitate to ask questions or reach out for help